A leading European retail bank asked Intenda to conduct a Fraxses point solution in its Corporate Banking division.

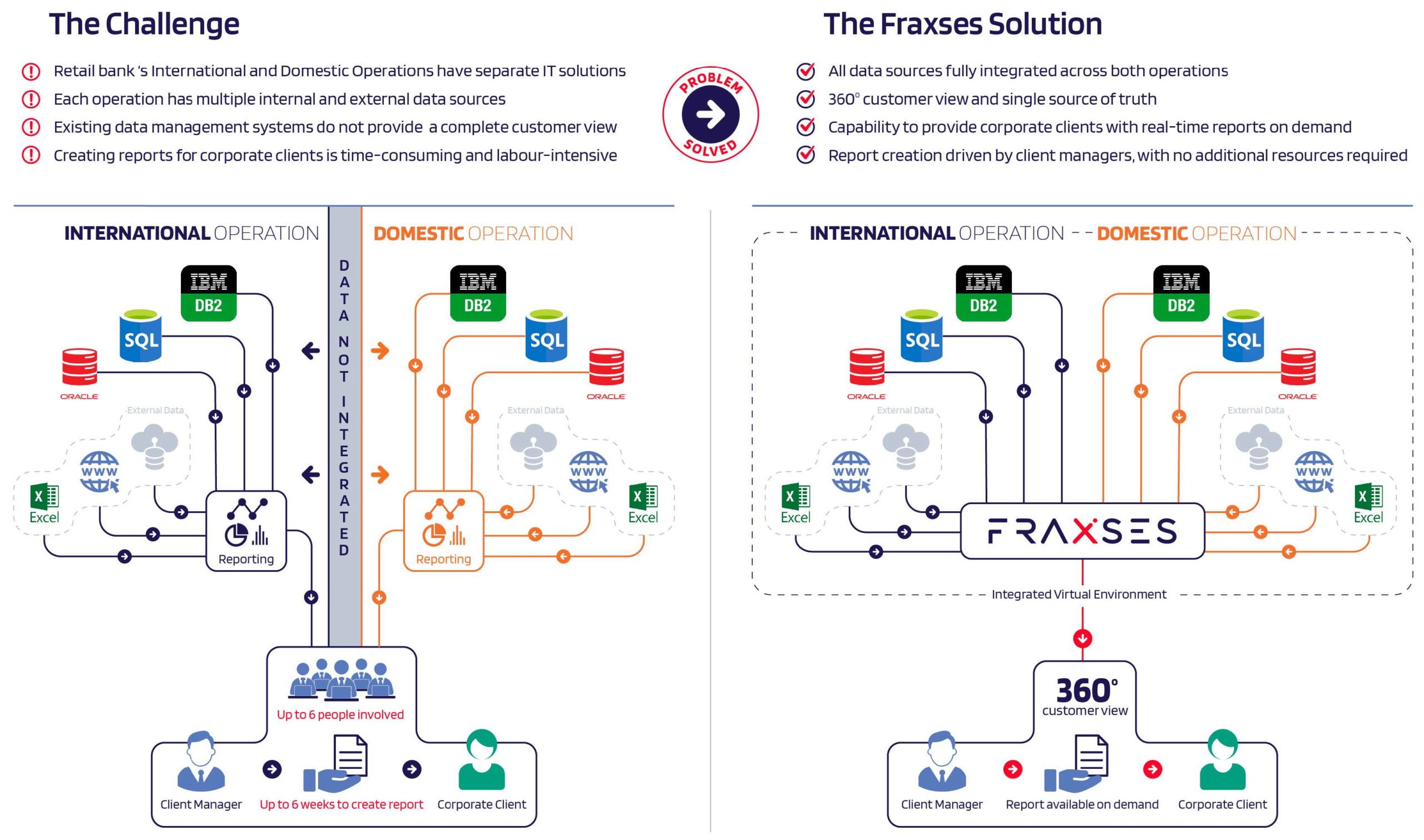

The bank’s existing data management systems did not provide a comprehensive customer view. As a result, client managers were unable to generate reports for corporate clients as and when they were required. The point solution’s objective was to deliver a 360° customer view, thus enabling client managers to provide upto-the-minute reports on demand.

Fraxses connects data sources so that they function as a single virtual environment. It can connect to any core business application, process unstructured information, and discover relationships between disparate data sets. The platform assures access to any data in real time, regardless of its location, size, or the technology it is in. Fraxses leverages metadata-driven data products that hold no data themselves. This makes it optimal from a GDPR compliance perspective, and allows organizations to integrate all their clientrelated data with full security.

These factors made Fraxses the ideal solution to deliver what the retail bank required.

Data source discovery involved 70 tables, some containing more than 100 million records. Fraxses took less than a minute to discover and capture the initial metadata.

The Fraxses implementation was conducted over 14 days, and presented the bank with

an excellent ROI:

Our monthly email newsletter content is relevant and engaging. We know your time is valuable and will not spam you.

Thank you for contacting us.

We will be in touch shortly.